Sell more with PayLater for B2B eCommerce

Keep your checkout flowing, with flexible payment and credit options.

B2B Payments to boost your growth

Keep your checkout flowing

Offer your buyers the choice to pay on their terms, while you get paid up front, in full.

Get paid upfront

Instant decisions

Mitigate risk

No more admin

See how Kriya works

Want to see our eCommerce checkout in action? Or see how to raise offline orders in our Merchant Portal? Check out the key workflows with our interactive product tour.

Offer credit to buyers in 45 countries

How PayLater works for B2B eCommerce

1.

- We check new buyers and give a credit limit in seconds.

- They choose to pay in 30, 60 or 90 days or in 3 monthly instalments.

- We pay you upfront.

- You fulfil the order as normal.

2.

3.

- Your customer pays us on their terms with their choice of bank transfer, direct debit or open banking.

- We handle collections and reconciliation for you.

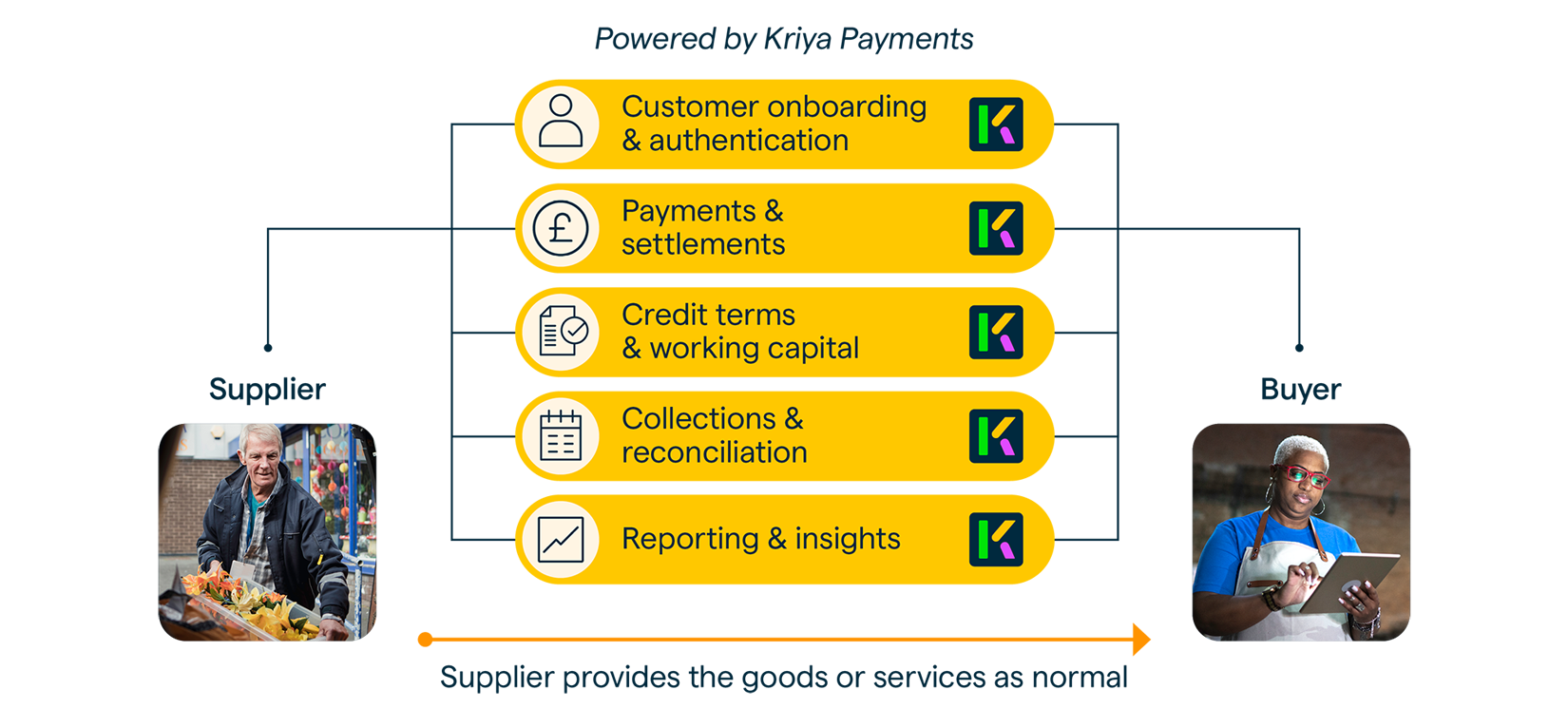

The end-to-end solution

for embedded finance

Integrate with Kriya

your way

Direct API

Most suited for merchants with a technical development team and can be completed in 2-4 weeks.

Hosted Payments Page

The development effort is lower and it only takes 1-2 weeks to integrate. It also updates automatically.

eCommerce Plugins

Kriya has plugins for WooCommerce, BigCommerce, nopCommerce and Adobe Commerce (Magento), with many more coming soon.

“Being able to offer flexible payment terms to our B2B customers underpins our market offering. We want to invest in modernising the checkout process and we’re excited to work with Kriya to digitise and provide flexible payment terms to a much wider range of trade customers.”

“Being able to offer credit has helped our customers manage their working capital and buy more. As a result, customers appreciate our service even more, as evidenced by higher repeat purchase and retention levels for customers that make use of Nivoda credit.”

"Integrating Kriya Payments has been quick and simple, the team were supportive throughout the whole process and we are already seeing results! Customers love the new offering and our sales team love being able to offer instant credit accounts to customers.”

%20(1).svg)

“Something I really love about the Kriya relationship is that it feels like a partnership rather than a service provider who's selling you something.”

"The integration process was very smooth, the team’s level of professionalism and efficiency in addressing issues left us thoroughly impressed. The team was well-prepared and had a strong understanding of the product."

“We expect our turnover to double year on year, and timely access to working capital provided by Kriya is critical for this”

“We've had significant growth since we've started offering credit at checkout with Kriya. We are now doing over £100,000 a month with Kriya just because we're offering that service for them. And I can see that that growth is just going to continue to skyrocket.”

Accelerate your revenue & growth

Hot off the press

We’ve advanced over £500 Million to support Barclays businesses

We celebrate the milestone of advancing £500 million to businesses banked by Barclays and reflect on the success of our partnership.

Digital B2B payments: early adopters will dominate their market

Early tech adoption is make or break for company success. In digital payments, B2B businesses cannot afford to be complacent.

How B2B leaders can unlock growth with flexible payment options

Show me the money! Our buyer's guide highlights the key considerations to modernising your B2B payments offering and accelerating your growth.

Kriya Product Pulse: February 2024

New interactive product tour, plus big new Merchant Portal updates

Kriya upgrades debt facility to power £1 billion in Payments over next 2 years

Kriya raises new £50M funding facility with long-standing partner, Viola Credit, to accelerate enterprise growth.

Don’t leave money on the table - digitise your payment terms

By offering extended payment terms, B2B merchants can grow revenue, stand out from the competition, and free-up working capital.

Kriya’s 2023 in review: transformational growth and positioning ourselves for the future

Our CEO, Anil, reflects on the big trends of 2023 and how these will shape the year to come.